‘God, what a week eh?’ has long been the banal greeting that begins every Friday afternoon meeting. But this week, there was something about the exasperating sigh that routinely follows those five words that felt heavier than most. After a week of daunting headlines about the spiralling state of the British economy, everyone feels defeated.

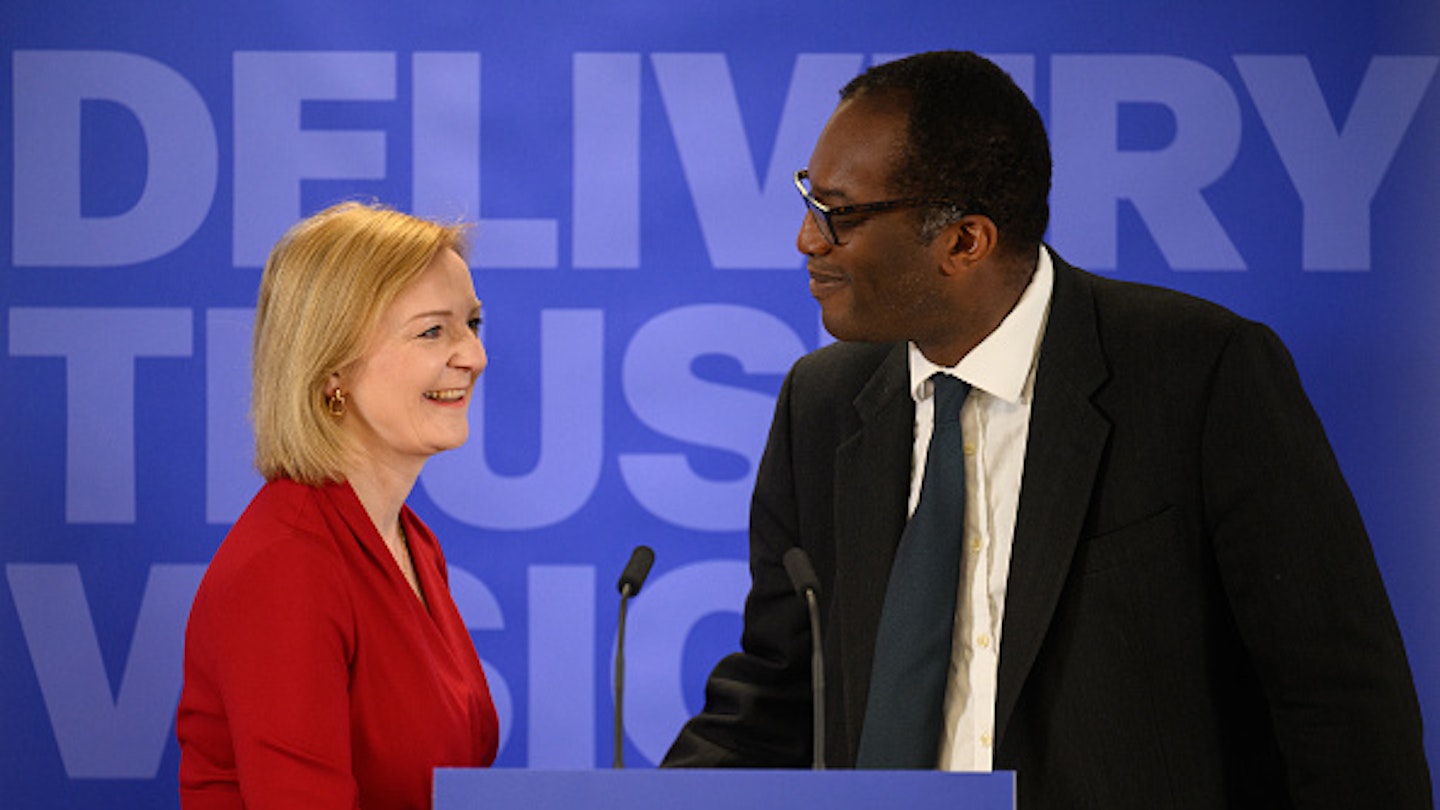

Kwasi Kwarteng’s ‘mini-budget’, announced this time last week, bank-rolled a series of confusing and daunting reactions from the global market. The £45billion tax-cut package that relies on government borrowing caused the pound to plunge, inflation soaring once again, and the Bank of England was forced to warn that they would have to raise interest rates to offset prices rising. Cue panic about the cost of borrowing, particularly mortgage rates rising beyond their already unaffordable rates.

The mini budget is supposedly intended to create long-term growth (based on the trickle-down economics theory that assumes the richest in society will use tax cuts to reinvest their wealth, a big assumption indeed). Read between the lines and it makes you wonder if the government perceive the immediate impact of families losing their homes, small businesses going under, and renters further prohibited from getting on the housing ladder to be a sacrifice worth making.

But even if we could ever agree that short-term financial ruin is worth the extremely theoretic ‘brighter future’ the government hopes it will achieve with this policy, young people are certainly left out of that picture. For them, the immediate impact of unaffordable mortgages sets their potential to own a property back years, if not decades. With stagnant salaries and rising inflation, the fact that interest rates rising to a potential 6.5% by the end of 2023 are crushing dreams of home ownership.

In fact, one audience member in Question Time last night has gone viral after revealing that her own mortgage application will likely fall through due to the news this week. ‘I just want to know what the plan is because I was actually in the process of getting a mortgage as a young person, and I was told my initial interest rate would be 4.5%, and I was told today that the lender has pulled that offer and now the best offer that I can get is about 10.5%,’ the woman asked the panel. ‘They’re saying you need to immediately look at putting your application through because the lenders may even pull these offers. For me now, as a first-time buyer, I don’t think I can afford to get a mortgage.’

For those who saw home ownership in the near future, the crushing reality of this week has hit hard. ‘Honestly, this all really scares me because it’s coming at a time when I thought I would be getting serious about owning my first property,’ says Abi*, 27, a social media executive. ‘I accepted early in my 20s that I’d be living in house shares for a long time, but I turn 28 soon and I really hoped I’d be closer to owning my own home by now, to be honest even just renting alone. I’d let myself dream about it more in the last year as I started earning over £30,000, but once again I’m knocked back down to reality that I have to share with strangers for the foreseeable future, moving every year as rent prices go up and up. It makes you feel like all of the work you put in to building a career is futile. I walk into work feeling accomplished, then come home to feel like a university student.’

Of course, the disastrous impact of the mini-budget transcends generations – many families will now struggle with the rising cost of their mortgage, as will small business owners, alongside spiralling prices. The emotional impact of that untold too.

‘I am a small business owner and I've been having terrible anxiety over all the financial news,’ says Dalia Hawley, 40, owner of Dalia Botanique. ‘It's been affecting my sleep as I wake up worrying about whether or not I’ll have a business next year. I'm panicking about the rise in costs for my business and the fact that consumers are cutting back on spending, at the same time feeling guilty about pushing my business on people when I know we’re all struggling. I lost my first business when everything shut down due to Covid, so all of this is bringing back that anxiety in a big way.’

I lost my first business because of Covid lockdowns, this brings back that anxiety in a big way.

Dalia also worries about Christmas coming up, and she’s not alone. According to consumer intelligence company QuMind, 43% of Brits say they will not be able to enjoy Christmas this year as they’re too concerned about costs and 52% fear they’ll struggle to keep their homes warm over the festive period. In total, 80% of Brits are worried about spending this year.

Ultimately, we’re all overwhelmed – and we can’t underestimate the health implications of that. Financial worries are currently the leading cause of stress, data from Champion Health has revealed, with younger people twice as likely to be affected. Financial stress is linked with severe forms of depression and anxiety, with over half of clinically depressed people citing financial stress as one of the major causes.

The emotional toll of the cost-of-living crisis is already disrupting people’s lives, and frankly, the government is playing with all of our health by risking radical economic theories that experts warn against. We need urgent action.