We hardly need to remind you that we - millennials, Generation Rent, Generation Y, Generation Spent or whatever - you want to call young people in this country, have been handed a pretty raw deal when it comes to housing.

Today Shelter have released new research which finds that, by 2020, first time buyers in England will need a £64,000 salary in order to buy a house, Londoners will need £106,000. That’s an increase of nearly a fifth on the £52,000 needed for a typical first time buyer’s mortgage today. As if that wasn’t bad enough, first time buyers will need a deposit of £46,000 to keep up with sky-rocketing house prices.

Shocking as these figures are, they’re hardly surprising. Particularly in the last five years the housing crisis in this country has worsened as successive governments have failed to build enough houses meaning that house prices have risen six time faster than wages. Sadly, this has been brewing for a while.

Where our parents and grandparents were able to buy houses at prices which were, reasonably, in line with their pay packets before living in them and watching their value go up, up and up, many of us are renting well into our late 20s and early 30s as we watch our wages remain relatively low while properties increase in value at the speed of light. As we sit in our rented homes, watching much of our take-home monthly wages disappear into our landlords’ pockets, the prospect of owning our own one day begins to look like little more than a pipe dream.

According to the latest figures from the English Housing Survey tenants in England now spend half of their pay on rent, while London renters spend 72% of their earnings.

Because renting is the new normal for young people today we need better regulation of the market, better renter’s rights and a fair deal for tenants. As things stand letting agents’ rule the market, and because of a lack of proper regulation and legislation can charge more or less whatever they like in terms of fees to tenants.

We are in the midst of a housing crisis, and yet, nobody really seems to be doing anything about it. The Government introduced Help to Buy, but, according to multiple studies, all that seems to have done is inflate the housing market further. Is it any surprise, though, that this was the best they could come up with?

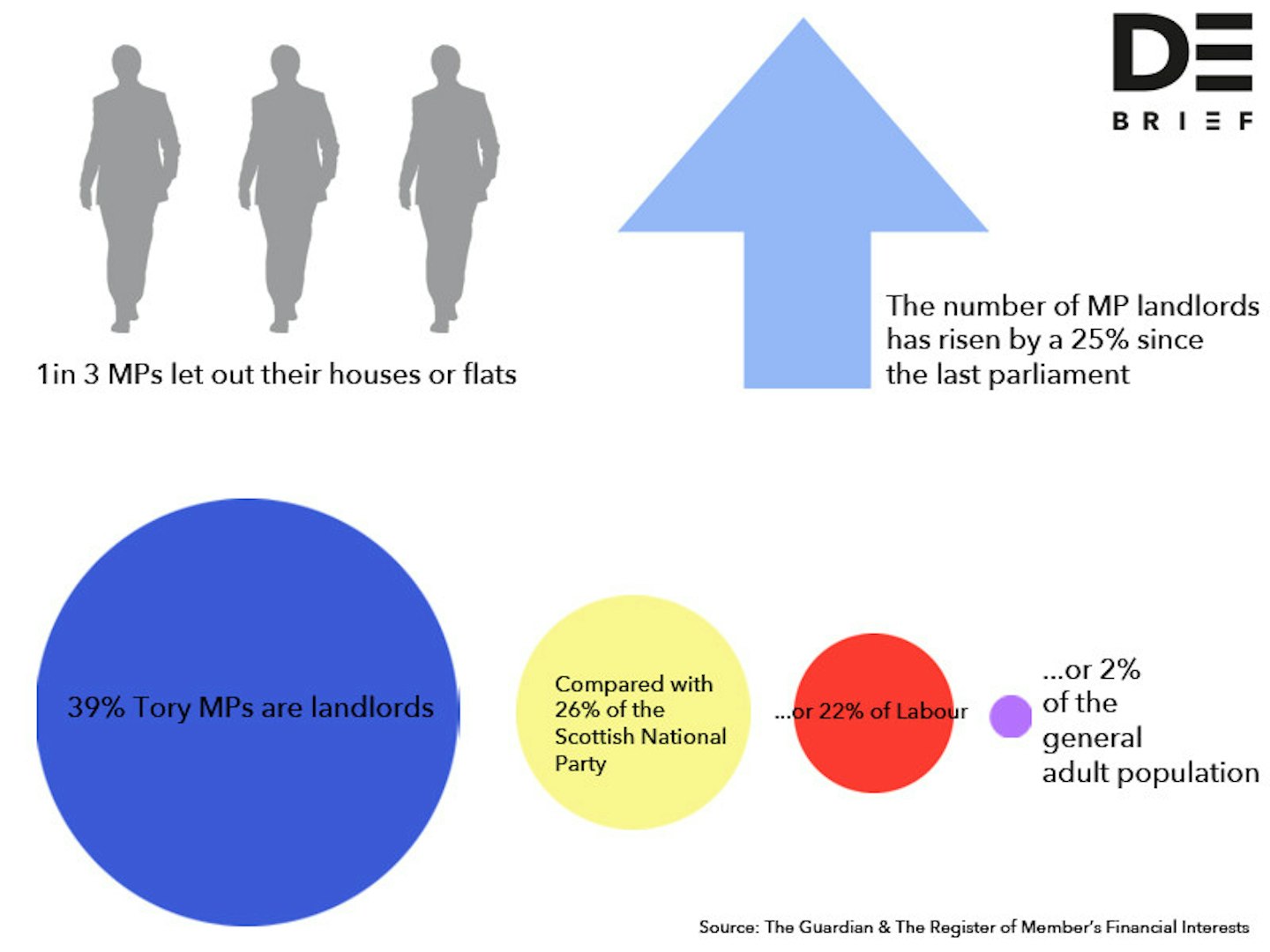

This country’s chronic housing crisis is currently being presided over a Parliament where nearly one third of MPs are landlords, including the Housing Minister, Brandon Lewis and our Prime Minister, David Cameron and Chancellor, George Osborne. In fact, the number of MP landlords has risen by a quarter since the last parliament. As the government pushes its much-debated housing and planning bill through, the number of MPs who are also gaining an income from renting out property is on the rise.

According to Guardian research and the Register of Member’s Financial Interests, 196 MPs are currently declaring rental income. The majority of those are earning in excess of £10,000 a year from property, on top of the basic MP’s salary of £67,060.

The Conservative party has the highest number of landlord MPs, with 128 of their MPs renting out property. This means that 39% of Tory MPs are landlords. This is compared with 26% of Scottish National Party MPs and 22% of Labour. To put this into context, it’s estimated that just 2% of the general adult population of this country are renting out homes.

When you consider the figures is it any wonder that Generation Rent aren’t being represented in Parliament? Is it any wonder that the majority of legislation favours landlords and that there is a reluctance on the part of this government to properly regulate lettings agents and ban letting fees altogether? All of the main political parties, with the exception of the Conservatives, pledged to ban letting fees before the General Election last year.

Governments are not supposed to represent the interests of a few, they’re meant to look at the bigger picture and take their cue from that. We are now living in a country where an entire generation are struggling afford to buy property and are being caught in a renting trap as a result. Some are even finding themselves in debt because the cost of renting is so high. This hasn’t happened by accident or by some unstoppable for of nature, it’s the result of political legislation and financial markets that could have been managed differently.

Teresa Pearce MP, Labour’s Shadow Minister for Housing, told The Debrief ‘when Labour put forward an amendment to the Housing and Planning Bill to set minimum standards in the Private Rented Sector, it was rejected by the Tory government – many of whom are or have been private landlords.’

For Generation Rent, unscrupulous landlords, extortionate rents and unregulated letting agents’ fees have become an accepted fact of life, but it doesn’t have to be like this. That’s why we, here at The Debrief, are calling on the housing minister, Brandon Lewis, to ban letting agents’ fees for renters in England (they’ve been illegal in Scotland since 2012).

You can see whether your MP is also a landlord here and you can find out more about our campaign to #MakeRentingFair and sign our petition here.

You might also be interested in:

Make Renting Fair: Why We're Calling For The End Of Letting Agent Fees

Follow Vicky on Twitter @Victoria_Spratt

This article originally appeared on The Debrief.