Money will forever big a big problem. I often think of it as a dark cloud of impending doom that unwaveringly lingers over the weary heads of eternally broke millennials. Bleak, right? Nevertheless, there's (still) little being done, out in the realm of government legislation or practical interjection, to alleviate what has become the number one anxiety for a generation plagued by student debt and a toxic reliance on rented property.

But this is all stuff that we know too well by now. If you're a graduate in your twenties, chances are you're currently living this painfully awkward reality and only dare to wince tentatively at your bank balance once a month on pay day. We feel you. Which, depressingly, is probably why you won't be very surprised to hear that our financial situations are so dire that 43 percent of us are waiting on inheritance money from our parents to eventually pay off the ridiculous debt we've accrued since our university years.

WATCH: Your Student Loan Explained

Yep, things are so royally screwed that, according to a new study by First Direct, 66 percent of millennials are expecting to inherit cash from their parents and many are banking on using that sum of money to pay of the debts that, as it stands, are way beyond our own financial capabilities.

The stats also say that we're not saving and, lol, of course we're not - that requires spare cash that we evidently don't have. More than a third of us aren't currently saving for retirement and a fifth of millennials would go so far as to say that our future lifestyles are dependent on what money we're left by our loved ones.

Research released by the Institute for Fiscal Studies last year found that two thirds of our generation will never be able to fully repay our student loans which alone lends itself to the hot housing mess that we currently find ourselves in (mortgage affordability checks tend to look pretty bleak when you've got a load of loan repayments against your income). Coupled with the fact that so many of us are already borrowing just to make rent, our reliance on a potential lump sum from our parents sounds frustratingly apt.

It's not the solution, of course. And there'll be many of us out there without parents with the fortunate financial means to drop a giant, debt-wiping cash bomb, but the fact that 42 percent of the 18-32 year-olds surveyed by are already planning to use any money they receive from their parents to ditch the debt puts an awfully depressing time stamp on when we'll finally be able to afford the rising cost of living: at the expense of our parents lives. I'm not sure it gets much more messed up than that.

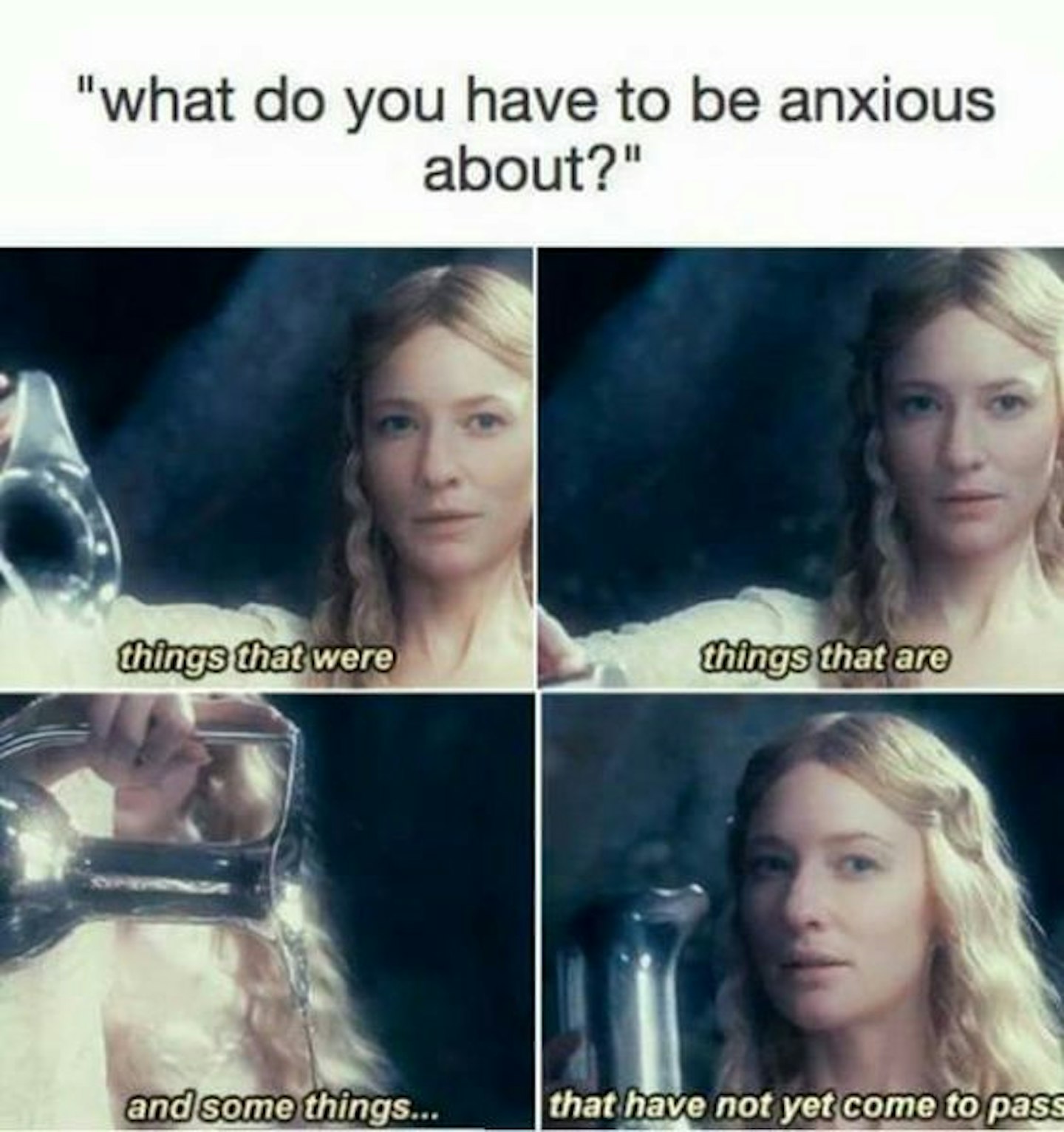

MORE: Memes About Anxiety That Are Almost Too Real To Lol At

The Debrief Anxiety Memes

1 of 16

1 of 16But seriously though

2 of 16

2 of 16#logic

3 of 16

3 of 16So that's where I've been going wrong...

4 of 16

4 of 16*recalls every bad thing ever done in entire life*

5 of 16

5 of 16Wbu?

6 of 16

6 of 16But, you know. No worries...

7 of 16

7 of 16Doesn't go to plan

8 of 16

8 of 16For the record

9 of 16

9 of 16Every, Single. Time.

10 of 16

10 of 16Internal monologue of nightmares

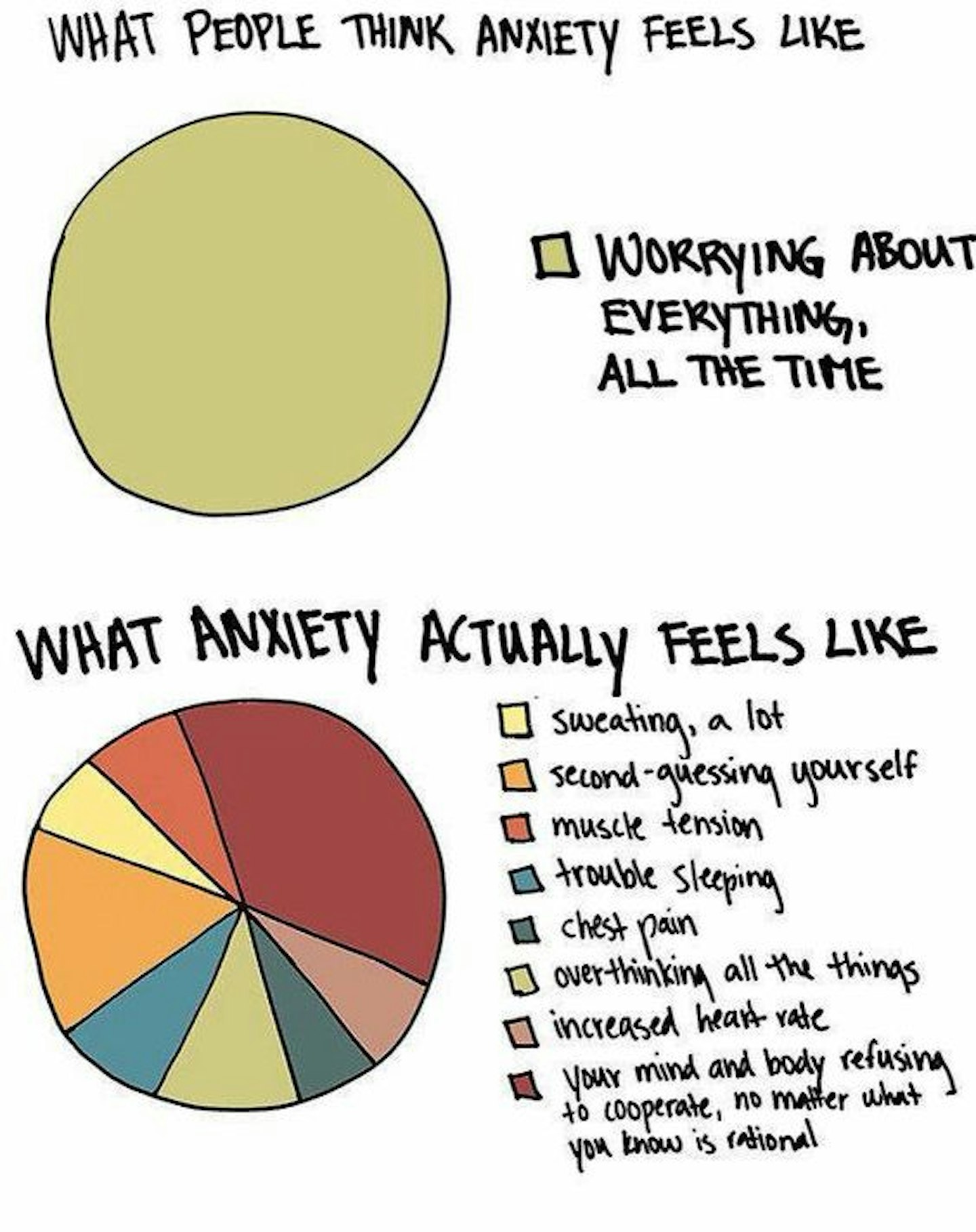

11 of 16

11 of 16Oh yeah. That.

12 of 16

12 of 16You hate me? I'm fired? Someone died? What is it?

13 of 16

13 of 16Can't.

14 of 16

14 of 16Got a pen?

15 of 16

15 of 16'WTF could you possibly want from me?'

16 of 16

16 of 16Don't question me, Carol.

Follow Jazmin on Instagram @JazKopotsha

This article originally appeared on The Debrief.