Sponsored by FSCS.

If you thought ‘lipstick connoisseur’ wasn’t a real job – think again. At 18, a now 26-year-old Flow decided to halt her pharmaceuticals degree to study Cosmetic Science at London College of Fashion. This girl loved make-up, to such a degree that beyond learning about it in the lab, she’d moonlight as a retail assistant in beauty stores in the evenings, dreaming about the day she’d have her very own beauty empire.

By the time Flow was 22, she’d founded MDMflow, a brand that focuses on 90s fashion and culture (we’re listening) and started out selling lipsticks.

Her dream became a reality during her final year at university after a report on how colour perception impacts how women feel about lip shades gave her this lightbulb business idea moment.

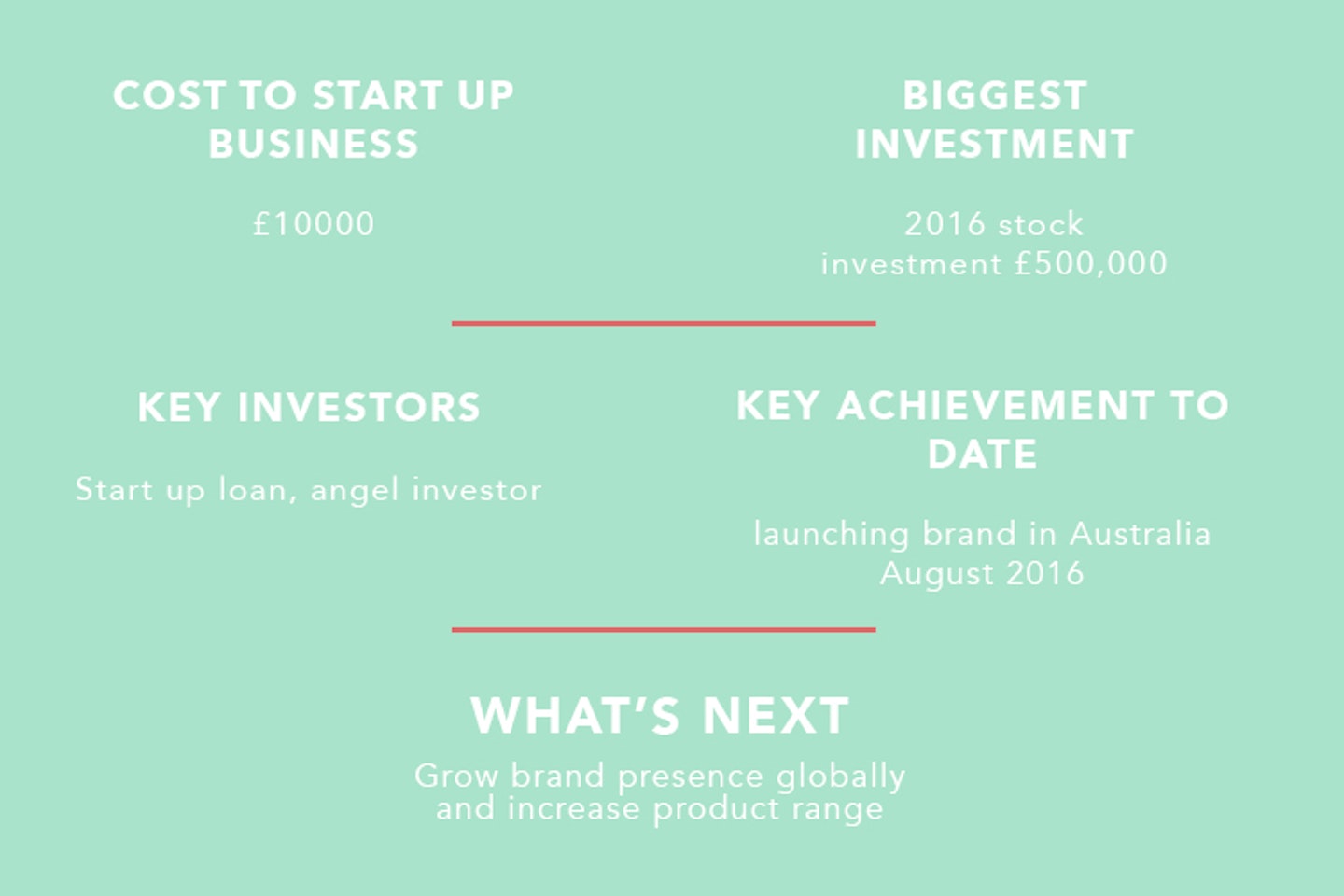

'I put together a proposal and plan to apply for a £10,000 business loan from a government start-up loan scheme with my university and I used that money to get the equipment I needed to build a lab at home.'

Although that might sound like a Cinderella-esque story, it certainly wasn't undeserved.

'I downloaded an e-guide to business funding and read it cover to cover before doing all the number crunching for my own proposal. It was a pseudo plan and in hindsight, it was probably super unrealistic but putting it together really helped me understand the different elements that needed to go into building a business.'

'My business plan contained financial models with information like retail sales, units sold, revenue predictions and financial goals. Now my plan is a guide which I use to review how the business is doing month on month.'

Looking back at it, Flow's not quite sure how she juggled it all: 'I was just so obsessed with getting my brand off the ground, I worked on it every spare chance I got.' Although she may have learnt the science of it all during her studies, it was through incessant research that Flow educated herself in the art of business.

'I'm obsessed with start-up podcasts, reading up on business and successful entrepreneur stories in my industry,' she admits. 'I Googled absolutely everything,' Flow tells us. 'From how to set up a business, how to pay tax to how to create a line sheet. Google has been an amazing tool for putting me on track.'

Considering her first office was her family's garden shed, it's safe to say Flow has always been pretty resourceful: 'I didn't have any other option but to set up there! I had the skill set necessary to formulate products but I couldn't afford the minimum order quantities the established industry factories were asking for so I started working in the shed the moment I no longer had access to the facilities at uni.'

Despite her start-up loan, Flow was still working at the time to invest her wages into getting her vision out there. 'Even now, 4 years in, I'm constantly making sacrifices,' she admits. 'I've had to say no to holidays and cancel plans with friends. Also, I'm always on a budget so my friends know not to suggest blow out meals or days out. I've also missed out on attending gigs and festivals but saying that, I think the sacrifices and risks involved are worth it.'

That's not to say it's always been so easy. Flow confesses to having tough times trying to stay optimistic: 'I've never had a plan B!'

'In the first few years, I used my loan to get my business of the ground alongside working in retail full time for two years -pumping all my salary into the business. And then, early last year, we raised our first round of investment so I'm now wholly on MDMflow.'

Now, Flow is focused on new product development and growing in markets her brand is currently already established in. But, what does she know now that she wished she knew then? 'I wish I had known about the start up communities in London and the advice and support available to young business. I have a community of young entrepreneurs now which I really cherish but they would have been so useful to have early on, too.'

This article originally appeared on The Debrief.