What did you do at the end of last month when you were waiting for pay day? Did you put anything on a credit card? Have you ever taken out a loan? Do you worry about debt?

We all know about the gender pay gap. However, it seems that there’s another gender-related gap when it comes to our finances. The highest number of people declaring themselves bankrupt are young women.

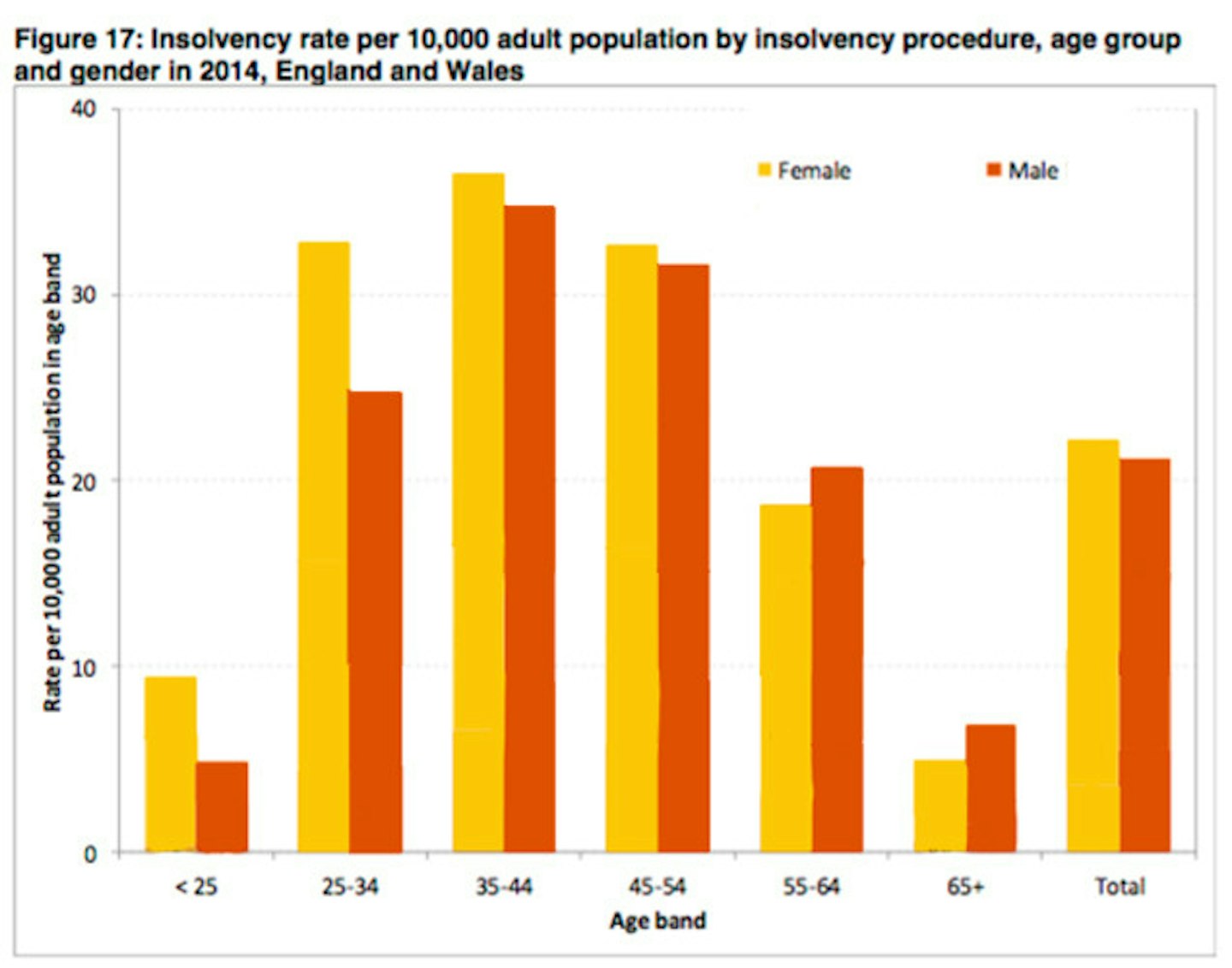

According to figures published last year by the National Insolvency Service, while the number of bankruptcies overall is down in England and Wales, young women are now more likely to fall into personal insolvency or bankruptcy than men. The gender gap is particularly noticeable when it comes to young adults, with 22.2 of every 10,000 women aged between 25 and 34 applying for bankruptcy or another insolvency status, compared with 21.2 of men the same age. This is the first time that the number of women applying for debt relief has overtaken men.

It doesn’t stop there; R3, the insolvency trade body, found that a key factor in female applications for bankruptcy is consumer debt (by this they mean credit cards).

Why are more young women than ever before going bankrupt? Why are more young women than men in so much debt? It’s not that we are all reckless spenders with shopping addictions. And with wages at a historic low, rents rising and the cost of living so high surely there’s more to it than that.

Indeed, as many as 20% of people in this country reported having to use credit to pay their rent in January 2016. The FT recently reported that millennials need to be saving £800 a month towards their pensions, but, according to the most recent statistics the average salary for a 25 year-old in full time work is actually just £19,300. You do the math.

The number of young woman declaring insolvency and bankruptcy has risen but how did we get here? Last September Citizens Advice warned that young people today are facing increasingly stifling debts and face being trapped by them. They said people aged 17 to 24 asked them for advice on 102,296 debt issues in the last financial year, that was up 21% from the previous year.

According to the report published by Citizens Advice, young people have an average debt to income ratio of nearly 70 per cent, compared to 11 per cent when it comes to 60-64 year olds.

How many young women do you know who struggle to make ends meet? Who use a credit card to tide them over at the end of the month? Do you know anyone who’s able to save £800 a month, ever?

Marina**, 26 says ‘it’s quite easy to get in debt, especially for people in their 20s. Mainly because the cost of everything is so high, like renting, if you move or relocate. You might have to take out a credit card to fund it.’

She cites the most recent Financial Times piece about millennials and pensions or, rather, the lack thereof, ‘articles which basically lambast millennials for not saving just make you feel like everyone’s laughing at you. It doesn’t inspire you to be sensible because you think ‘where do I get that sensible advice from if everyone’s taking the piss?!’.’

Does she think that our generation, as the FT article suggested, are struggling because we ‘insist on a YOLO lifestyle’? ‘Yeah, we probably should be more sensible with money but when rents are going up and wages stay low where do you get that money? Where do you save? I don’t feel like there’s any good financial advice for our generation.’

And what about her? Is she in debt herself? ‘I do have a credit card which I took out initially to get braces on my teeth because I didn’t get them as a kid. I guess it wasn’t a necessary expense, but having the card there have been times when I’ve thought ‘Oh I’ll just go shopping or on holiday…it won’t hurt if I put more on it. Once you’ve got it, if you don’t have great willpower, you might use it for things that you don’t need.’

She adds, ‘I actually ended up taking out another one and doing a balance transfer. I keep saying I’ll pay off the other one and cut it up but I haven’t. I also took out a loan a few years ago. I didn’t particularly need to do that but I was going out with someone at the time who earned a lot more than me. We were moving and I wanted to put some money into the deposit, I didn’t want him to have to pay for everything. I was also going to use half of it to pay for my overdraft but I ended up on holiday. So I’ve still got the expense of paying that back, it’s £200 a month which I could do without. Again, I wasn’t really earning very much at the time and I didn’t really know where to look for budgeting or saving advice. It wasn’t a good idea but nobody at the bank questioned it or offered alternatives so it just seemed like an easy option at the time.’

Does she worry about her debt? ‘I’ve worried about it more in the last few months because I recently went freelance, but I’m not at a point where I’m not able to pay anything off so it’s ok.’

Marina’s not alone. Sarah, 28, tells me she also has multiple credit cards and a loan. She’s in full-time employment so how did she get here? ‘I had to move out of my flat a few years back’, she says, ‘my flatmate earned more than me and she wanted a nicer place. I didn’t want to live with anyone else so I just took out a loan to make up my salary and cover the rent. It was stupid I know, but at the time I didn’t feel like I had any other options.’

And what about her credit cards? ‘I never had a credit card or even an overdraft as a student. In fact, I think I was pretty good with my money. But then, I moved to London and started working. I earned about £24,000 to begin with but that meant all I could afford was travel, rent and a few nights out. I couldn’t go on holiday or buy clothes. I worked in a very smart office – I didn’t own any shirts! So, I put it all on a credit card. And, now, I’m still paying it off.’

Does it worry her? ‘I mean, I have to be honest, yes it does. I know in the grand scheme of things it’s not a huge amount of money but, still, I don’t like the feeling of owing money of being charged interest. I know I’m going to be fine but sometimes I have nightmares about being taken to prison because I can’t pay it back. I know that won’t happen but still.’

‘Also’ she says, ‘what happens if my salary never goes up?! I spent that money thinking one day I’d be earning big bucks. But I still haven’t hit 30k! My dad said he thought I’d be earning loads by now, he doesn’t get it.’

Gillian Guy, chief executive of Citizens Advice, said ‘a new generation of young people are starting out with stifling levels of debt. Many young people already face challenges getting on the career and housing ladders – doing this while saddled with huge unsecured debts makes it an uphill struggle.’

It’s a sorry state of affairs, and the current climate doesn’t help. More than anything it’s difficult to plan financially when you’re renting, when you don’t know when your rent might go up or where you’ll have to move next. Not to mention that fact that many people graduated already in debt. Young people today don’t ‘insist on a YOLO lifestyle’ as the FT put it, our outlook reflects the instability and unpredictability of the times we find ourselves becoming adults in.

We need better long term solutions, particularly when it comes to the housing market. However, for those who are in debt and struggling we need better independent advice, guidance and support to help them manage it.

If you are concerned about your debt contact the National Debtlinefor free, impartial advice.

You might also be interested in:

It Will Take You 24 Years To Save A Deposit To Buy A House, Says Study

Follow Vicky on Twitter @Victoria_Spratt

This article originally appeared on The Debrief.