Ever cry at cash points, or lie awake at night wondering whether you're on track for your age? Whether you're doing OK? Whether you're awful with money/too sensible with money or whether you're the only 28 year old in the UK who doesn't have any savings? We asked five 20-something girls in five very different life situations to tell us exactly what they've got coming in, exactly what's going out, exactly what they're left with and exactly how much they have in their bank account right now. From the girl who packed it all in to go travelling, to the girl who is currently on the property ladder, here's what UK 20-something girls' bank balances look like right about now.

Obviously we won't be naming the girls, because would you like the world to know how much green you're packing right now? Exactly. We've given them nicknames, to protect their identity (and to stop their mums worrying because hey, we're all going to be OK).

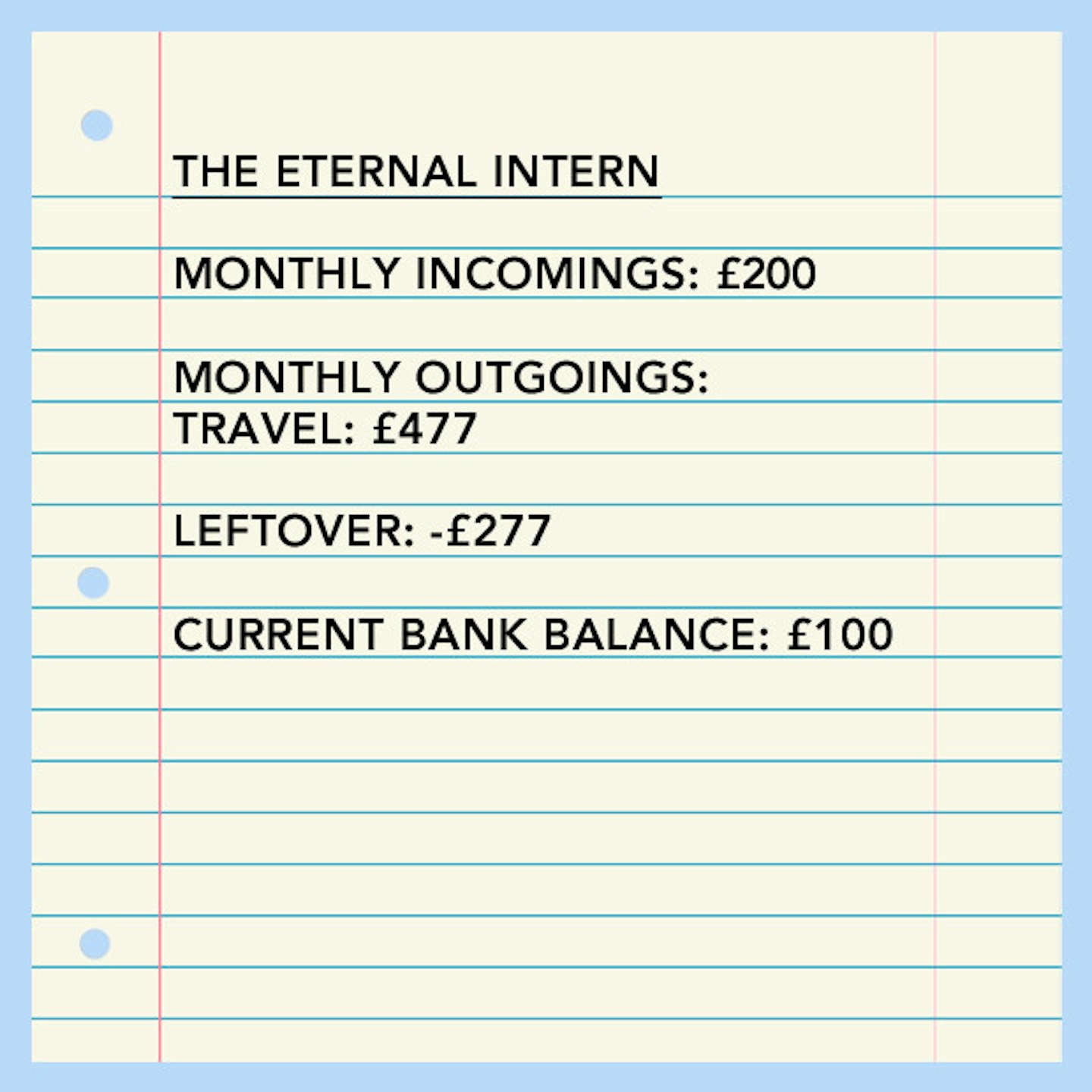

The Eternal Intern

The Intern is 22, wants to be a journalist and is interning (obviously, hence the name). 'I'm currently in a bit in an inbetweeny place - I am doing an internship that pays, but it comes to an end next week so I am moving on to a couple of month-long unpaid internships, which means my financial situation will all change. For the worse,' she says. Currently, she's paid £75 a day but isn't paid for bank holidays or sick days, and it works out at £1,300 for the month - but this isn't the usual, as she tends to do unpaid internships, so she's still not in a position to move to London (which is where she wants to be) 'Luckily, I live with my parents and, although this is good because I have few outgoings for food or rent, my commute costs me currently £350 a month and when I move on to my unpaid internships it will cost me £477 a month as they are central London rather than Greater London.' Considering an expenses-only internship is around £200 a month, you can see that The Intern will, as of next month, be left with pretty much nothing.

'I am very happy that I’m gaining incredibly valuable experience and meeting lots of amazing people, but sometimes when you work very very hard, commute every day and don’t earn much money it can really impact your overall happiness and stability - especially if you're doing it long term,' she tells us. 'You sort of panic that you may never get a regular pay cheque you can live off and I feel so far behind my friends who are beginning their careers in well-paid jobs and managing to live independently.'

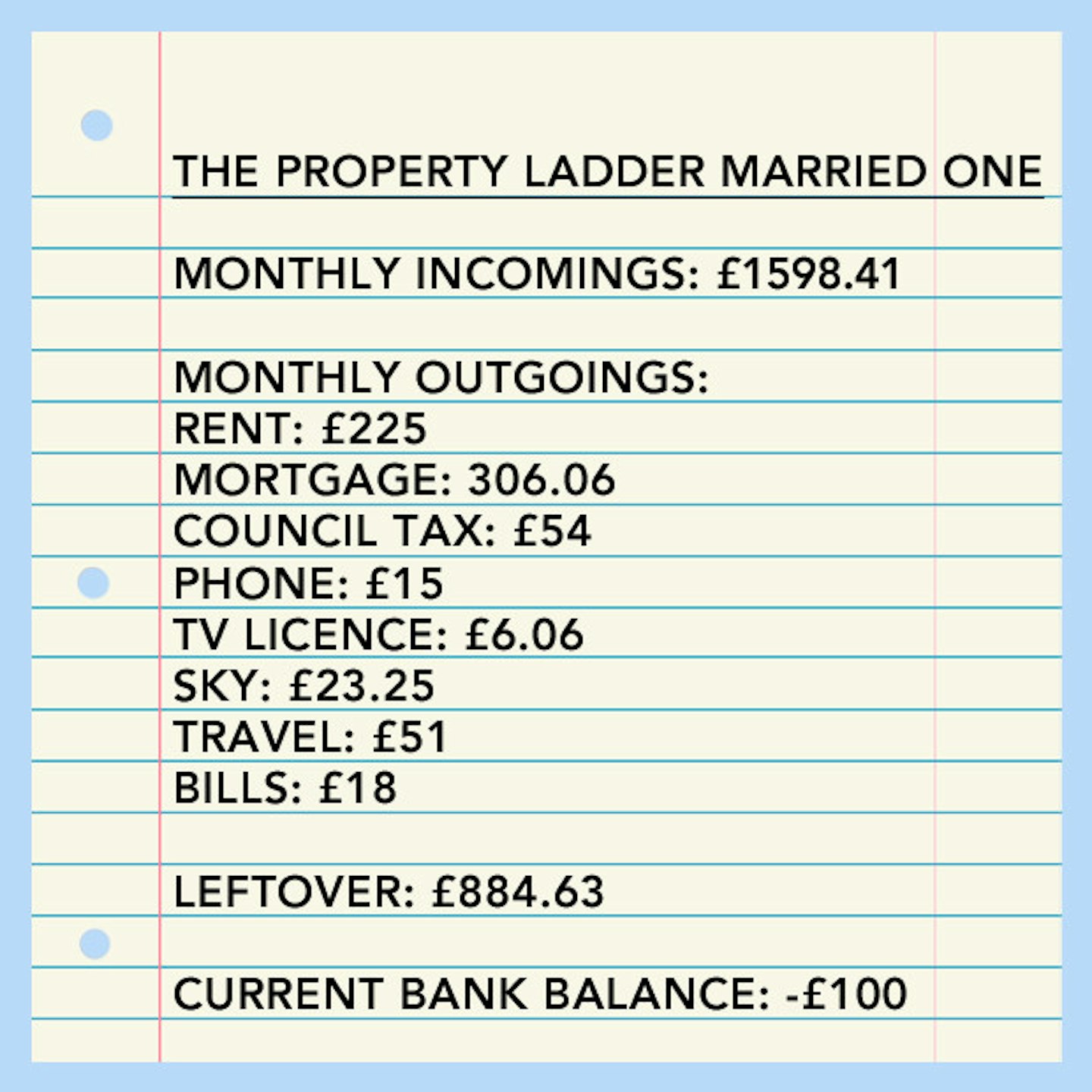

The Married One, On The Property Ladder

For brevity purposes, let's refer to her as MOWP (Married one with property). She's 27, works in the healthcare sector and has a joint account - so the money you can see on the above breakdown is half of what's really going on. 'Both our wages go into our joint account which all our bills go out of - my account is just for me and I take out about £200 from the joint account to put into my account to spend/save as I like,' she explains. 'Due to a weekend away and me buying summer clothes, my account is currently £100 overdrawn - but our joint account always has a £1,000 buffer.' MOWP lives in the North East, where living expenses are beautifully low.

They're on the property market, but it isn't all joy and money and rainbows. 'We were told that, due to various things, the chances of selling the flat we live in were pretty slim, so we became so-called accidental landlords,' she explains. 'Our tenants are now moving out and it will be empty, so we will be paying rent and a mortgage without income from the flat, a risk we took, and frankly, it's shit.' Paying double is shit, yes, but keeping the flat on the rental market means that they've got a real investment for the future - and the future is something MOWP really cares about.

'As I am one of lifes worriers, I did a degree from which I knew I could go straight into a fairly solid good job with a modest steady income and salary progression. I started paying off my student loan and paying into a pension, all at the age of 21. 'I don't know where I am compared to others, but I am happy. I can afford to live and do the things I want (within reason), but it's unlikely I'll ever earn big, big money, and sometimes I do wish I'd taken more risks and not worried about the future as much,' she concludes. 'On the flip side, if I hadn't earned the money that I have, then I wouldn't have been able to go on so many holidays!'

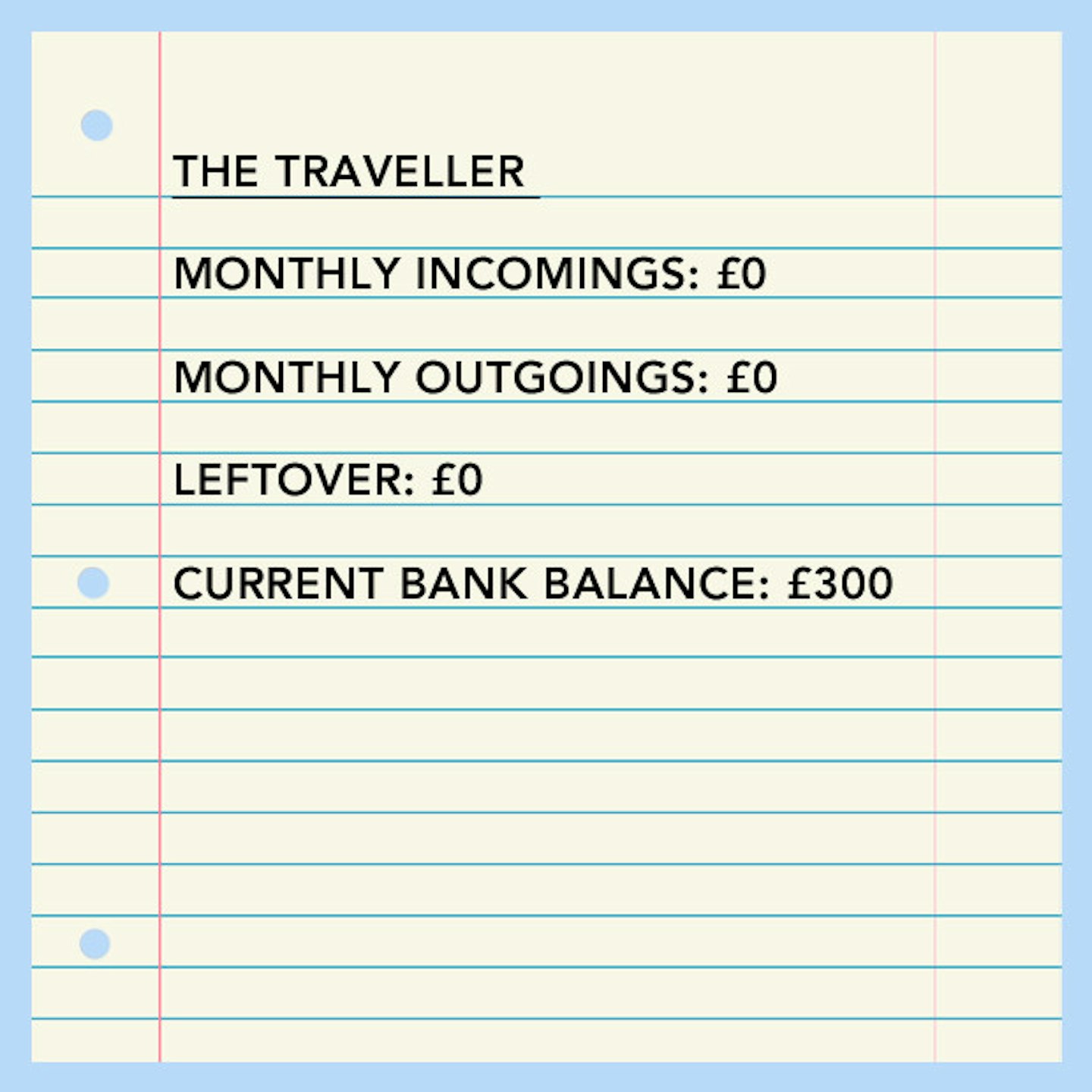

The Traveller

Having worked as a hairdresser for six years over going to uni or sixth form, when The Traveller turned 20 she'd managed to save a load of her £1,300 a month salary to go and explore the big ole world. 'I knew a year before I left that I was going, STA did a great deposit scheme where you put down £49 on flights and any tours (I personally wouldn't recommend the tours, it was loads cheaper to do it yourself) so I had plenty of time to sort my finances,' she says. 'I had a car on a hire purchase scheme and needed to sell it fast - I think my boyfriend and I left the UK with roughly £2,000 each, after the flights to Thailand and Australia. I know it wasn't that much but we weren't planning on having a holiday for a year, so we were definitely going to work whilst we were away!' They travelled around Thailand, before getting jobs in Australia, where she earned the equivalent of £1,300 a month. On top of that, they worked in farms and in hostels in order to fund the fun bits of the year-long break.

'We're pretty much going back to England with nothing, but Australia do a great thing called Tax Back For Travellers and Superannuation Money Back (a retirement fund they make you pay into when working) so everything they make you pay for government purposes, you get back. Well, you get about 40% back, but that's still a fair amount,' she says - which is a great tip for anyone planning to travel and work in Australia. She'll be getting around £1,000 back, which is a massive help. 'Yeah I've not much money left to my name, but I can say I've done this and afforded this All. By. Myself.'

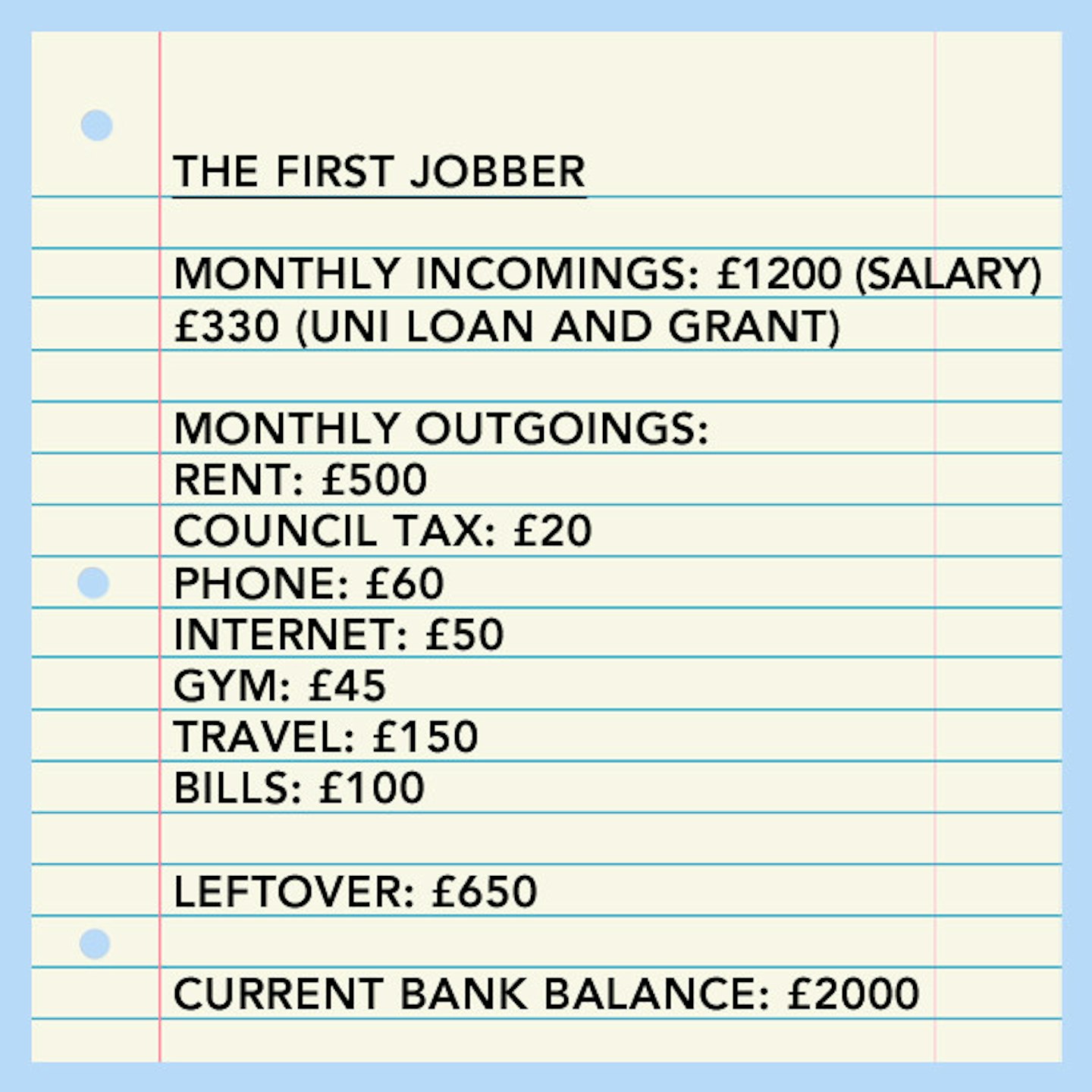

The First Jobber

After studying her MA part time while living at home, The First Jobber (23) thought she'd be loaded (what with no rent and all that) but the travel costs meant it was difficult to save. 'I work full-time now, but when I was part time and waitressing, all my income went on trains. I'd earn about £400 a month and spend about £300 on trains, although I got really excellent at hiding in toilets and other classy ways of avoiding ticket-people,' she says. 'I've saved up about £2,000 and I'm really loathe to touch any of it - because I worry about things I feel like I have to save it for some future situation where I'm sacked or accidentally have a child or something.' Now, her and her boyfriend are moving away to rent in Birmingham while he goes back to uni - they've lived in her parents house for years now - and after lots of spreadsheeting, feel they can afford it. 'I feel like I'm in a much better situation than most people my age as most of my friends are hating their jobs and have had to move back home with their parents,' she says. ' I feel reeeally grateful because I know that, if I hadn't got this job, I would be spending most of my time crying into a pillow because job hunting is a terrifying situation to be in and I don't deal with terror very well.'

She's also done a great job of saving, considering the amount of her income that was going on travel - even when she was working part time: 'It's good I suppose, but then sometimes I wonder why I decide not to do fun things which cost money because I have that money earmarked for future doom.'

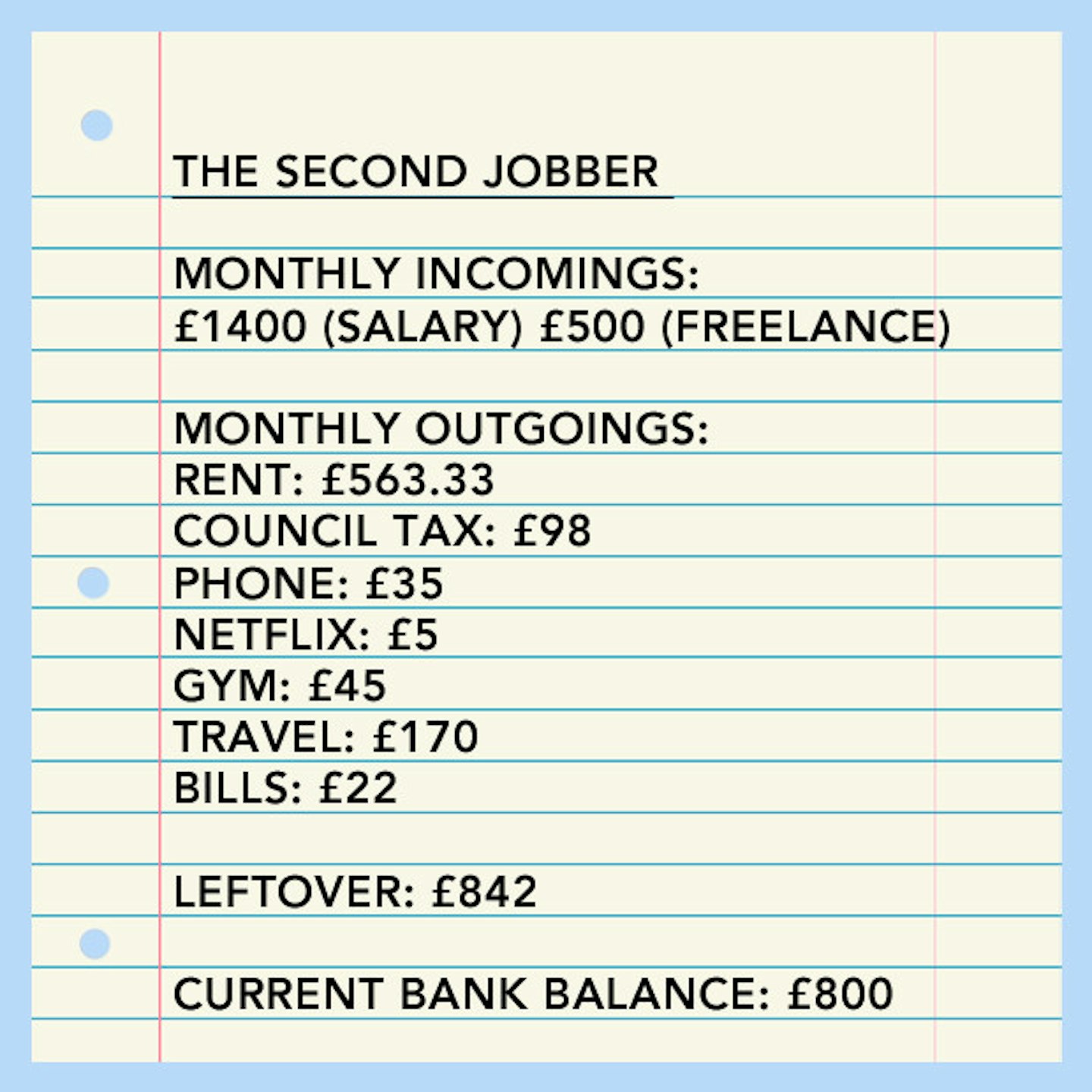

The Second Jobber

Living in London, The Second Jobber is 27 and balances three different jobs - as she wants to work in the arts, but doesn't come from money. She's worked as a waitress for years, and finally got her first job in 2013. She has a BA and an MA and only managed to get higher than an £18k salary at the age of 26. 'I've worked effing hard, and now have three different sources of income which makes it both fun and incredibly difficult to do a tax return,' she says. 'I'm also not as good with money as I would be if I was getting just a set salary - because I don't know where my pay cheque is coming from, except from the monthly £1,400, I can think I have more coming in and I do, or a freelancer cheque is late and I realise I'm screwed.'

She doesn't live with her boyfriend, and spends most of her leftover money on luxuries like going out for meals and after-work pub sessions on the two nights a week she isn't working on her creative side project. Having gone from waitressing and living off nothing, she's still adjusting to the fact that her salary - with everything combined - probably breaks the £25k mark. 'I never took a gap year, and I never go on holiday, because I've spent so long being incredibly poor that I'm not used to having a healthy-ish bank balance and I don't know what to do with it,' she says. 'Now I'm 27, and I'm not sure I ever will go travelling - because I'm terrified I'll undo everything I've worked so hard for. And that makes me sad. I also rent and still live fairly like a student - in the next few years, it'd be good to move in with my boyfriend and share the living expenses a bit so I can save.'

Like this? You might also be interested in...

Thinking Of Jacking It All In And Fucking Off? Meet The Girls Who Did It

Follow Stevie on Twitter: @5tevieM

This article originally appeared on The Debrief.