‘The financial hangover from both my maternity leaves affected every part of my life,’ explains writer Clare Seal. ‘I returned to work when my second child was 4 months old out of necessity - it’s the hardest thing I’ve ever done. I was working full time, meeting my husband with the baby every lunchtime to breastfeed, pumping twice a day at work, and looking after a four-year-old too. I was exhausted, we were still struggling to make ends meet, and our bills began to go on credit cards.’

Statutory Maternity Pay (SMP) in the UK is currently £156.66 per week, which amounts to just 47% of the National Living Wage. Last week it was announced that SMP will increase to £172.48 a week from April 2023 - roughly in line with inflation – along with other benefits. But with SMP levels already falling well below levels most people could realistically live on, charities and campaigners fear new parents are increasingly facing a choice between debt, destitution, and returning to work far earlier than planned (an option which comes with its own issues, due to the extortionate cost of childcare, which is highest for babies under one).

Before going on maternity leave with her daughter, now seven months old, Karlene Douglas, from Dundee, worked as a teacher and community outreach coordinator, as well as in a second job as a social care officer. After three months on full pay, Karlene dropped onto SMP, leaving her thousands of pounds a month worse off. The higher earner in her relationship, Karlene worked right up until her daughter was born, and quickly burnt through her savings once on SMP. ‘I took on a small part-time job but realised I’d forfeit my SMP, so I managed to persuade them to let me do the work freelance, which means I can still claim my maternity pay.’

On top of this, Karlene has taken on evening tutoring work and rents out her spare room to students, but even then, the situation is taking its toll. ‘I’m constantly stressed, my brain goes at 100 miles per hour, and while I’m doing night feeds, I’m checking what direct debits have gone out and can’t get back to sleep due to worry.’

‘We know the consequences of low maternity pay are severe,’ explains Rosalind Bragg, director of Maternity Action, who is campaigning for SMP to be raised in line with the National Living Wage (£332.50 as of April 2022). 'Women are spending their maternity leave worrying about money, returning to work earlier than they would like, ending up in debt, and increasingly using food banks.’

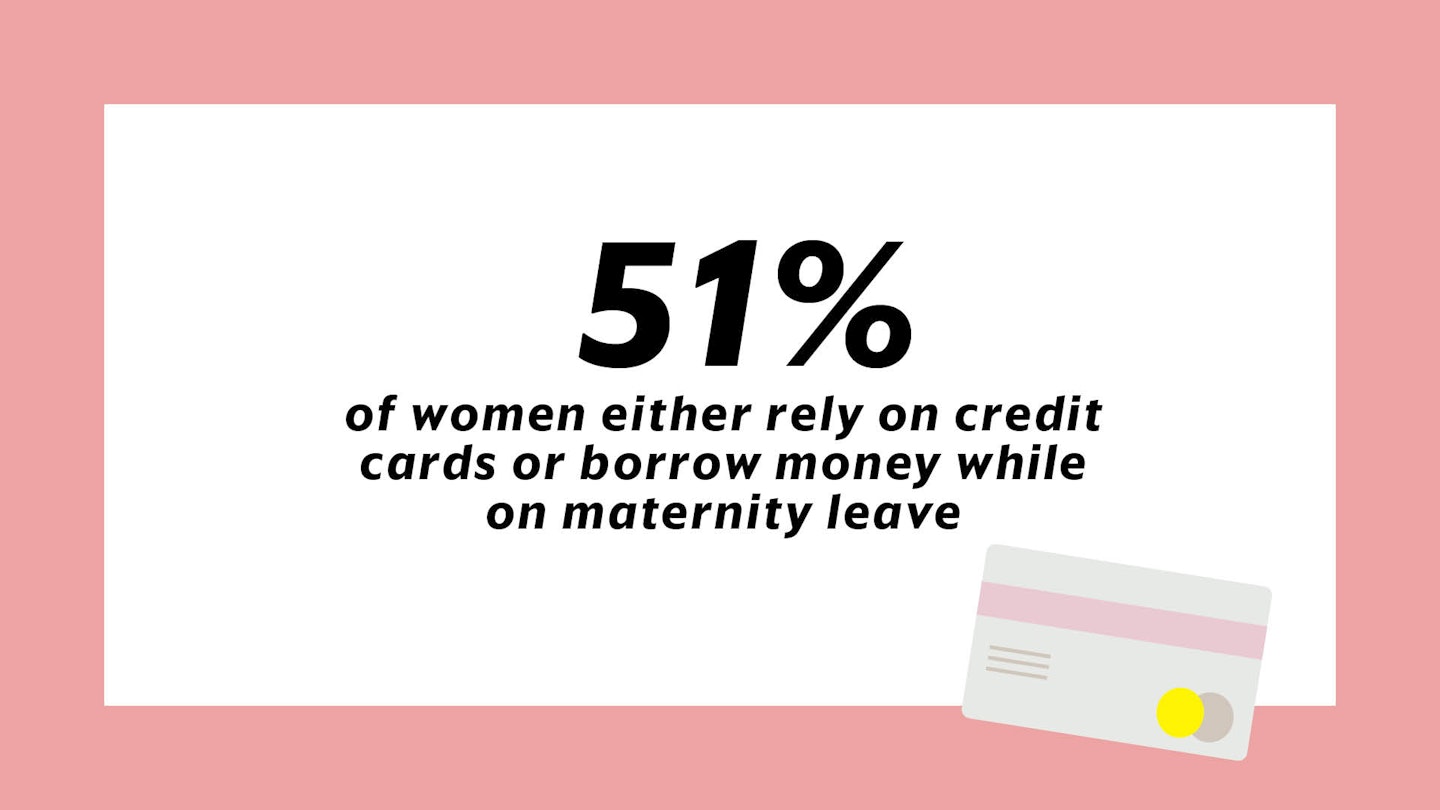

A cost-of-living survey carried out by Maternity Action earlier this year found 51% of respondents had either relied on credit cards or borrowed money while on maternity leave, with many saying they had saved up for years to cover the cost of their maternity leave but discovered they didn’t have enough to cover it. What was already an issue – SMP wasn’t enough 12 months ago, and it certainly isn’t now – has been compounded by the current economic crisis. With inflation currently running at just under 10% and energy bills soaring, it’s inevitable that women who felt that they had financially prepared for the cost of having a child will discover their money simply won’t go far enough now.

Of course, this is if you can save for maternity leave in the first place. Not everyone is a) facing a planned pregnancy or b) has money spare to save.

This was the situation Clare Seal and her partner found themselves in, and eventually her debt snowballed. As a result, Clare set up a then-anonymous Instagram account, My Frugal Year, which charted their efforts to pay off their debt. But Clare only felt able to do this once her eldest child started school, which meant no nursery fees and jobs with slightly better pay. ‘There’s a mindset element to the mess we found ourselves in. But higher mat pay and affordable childcare are two things that would have made a big difference.’

Another knotty question that comes up is who covers the debt burden that women face during maternity leave? If you’re used to splitting the bills 50/50 from two separate bank accounts, it can be tempting to keep going as normal - with the woman whose income has suddenly dropped filling the shortfall with her own credit cards or personal savings.

This is what Naz did when she was on maternity leave with her daughter, now four. 'We saved for maternity leave but nowhere near enough. I had all the direct debits going out of my account and he would send me his half, and then it would all go out. I think we did OK for about six months, and then I found myself putting things on credit cards so the mortgage would go out.’

But then the couple broke up just as she went back to work - and she unexpectedly found herself a single mother with a significant amount of credit card debt, built up covering her half of the bills whilst on SMP.

Every woman I spoke to told me any debt they’d accrued on maternity leave had been in their name alone. A study carried out by finance company Credit Karma this summer revealed 26% of women get into debt on maternity leave, with an average of £2,800 borrowed per parent while on leave. The study also discovered those with outstanding student loans faced a severe penalty in that period, accruing an additional £1,770 of loan interest in just six months of leave.

The system is a mess and appears to be based on an economically outdated assumption that one partner (the mother) will be earning significantly less than the other (the father), with women expected to live off SMP at one of the most stressful and expensive periods of their lives.

The solution seems straightforward - higher rates of SMP and affordable childcare are the key to making maternity leave affordable. But the women I spoke to also said there’s a significant lack of education and conversation around the financial implications of maternity leave, when it should be obvious to all that SMP falls short.

It’s presented as a special time for you to bond with your new baby, but for many women, it’s becoming financially ruinous. Yet while your HR department will explain how Keeping In Touch days work, and your health visitor will ask how breastfeeding is going, no-one encourages you to think about how your new financial situation might change the dynamics with your partner.

‘People spoke to me about the cost of childcare but not the cost of maternity leave,’ says Karlene. ‘I thought it would be this magical time, but I’ve not heard anyone speak about this. I wish there was some recognition of the fact that I’m working really hard and I’ve always worked really hard. It feels like I’m being punished for that now. The difference between my normal wages and what I’m expected to live on is huge.’