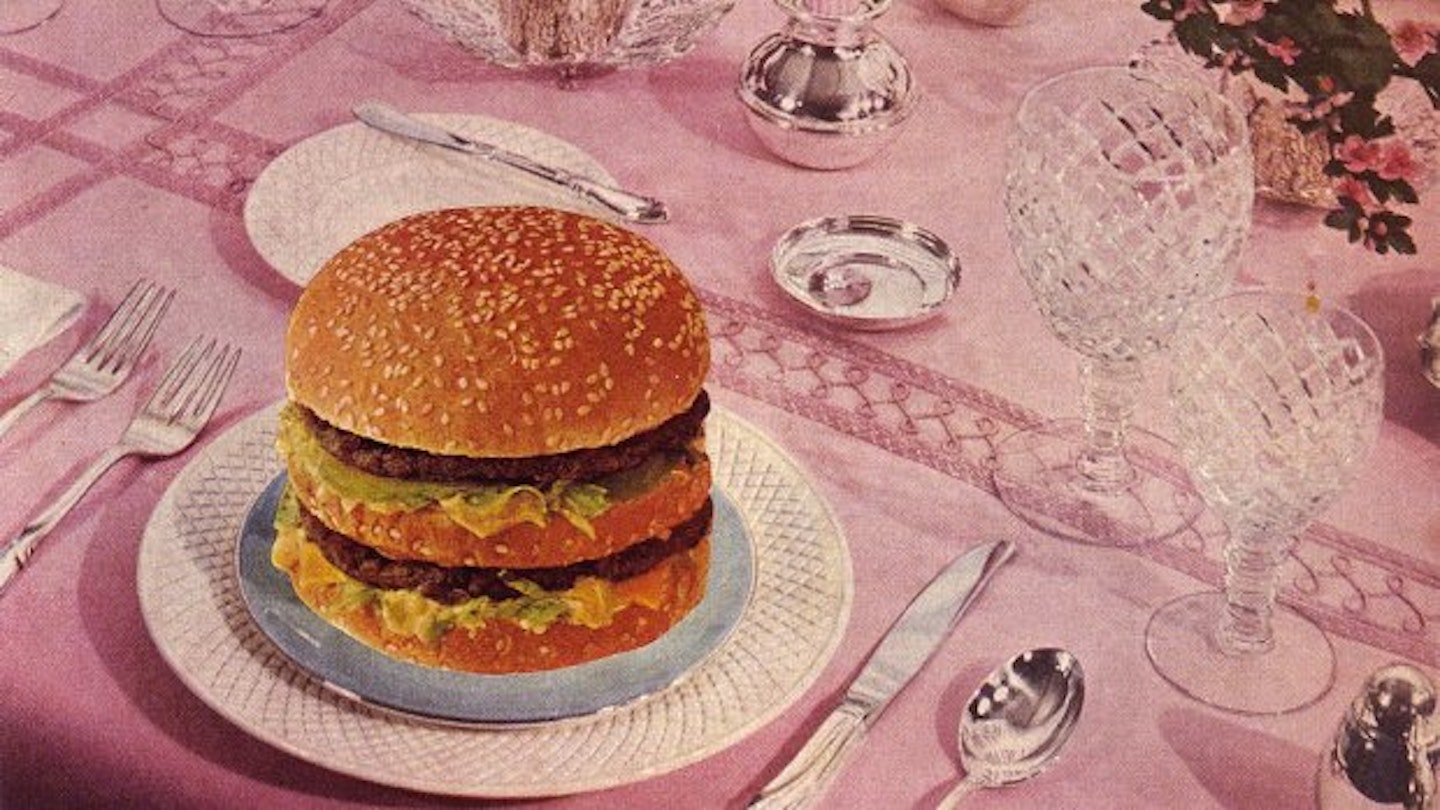

When I read that most self-employed women earn less than 10K a year, I was horrified. Then I remembered that in my first year as a freelancer, I earned just over six grand. If I’m honest, I’m not entirely sure how I made it work, because no amount of sensible budgeting and saving was going to put me in a position where I didn’t hold my breath every time my debit card went in a chip and pin machine. I lived on champagne and tiny burgers, not because I was an extravagant weirdo who had no sense of my dire financial straits, but because I had to live on whatever I could eat at events, and tiny burgers were - ironically - huge at the end of the last decade. Freelancing for a magazine meant I had the run of the beauty cupboard, which was a glorious perk, but if it wasn’t for all that free shampoo, I’m honestly not sure how I would have washed my hair.

According to HM Revenue and Customs, self-employed women earned 40 per cent less than men in 2012. The average income for a self-employed woman was £9,800. And although more managed to break the 10k barrier in London, most of them have been earning less than half the average self-employed male’s salary of £25,700. A recent study at the University of Chicago found that men tend to exaggerate their own abilities when they’re applying for roles, and employers tend to fall for it. Whereas women are not natural braggers, meaning they might miss out on the big money jobs. And if you’re freelancing, confidence is a prerequisite, as you need it to argue for the perks, privileges - and money - that you’re entitled to. This stands whether you're a freelance writer - like me - a self-employed plumber, or run your own small company.

Freelancing expert Diane Huff says it’s crucial that we toughen up. ‘Undervaluing our skills and experience is probably the biggest mistake we women make when it comes to setting our fees as consultants and freelancers. Why do we sell ourselves so short? I think it’s due to this mistake - we consider ourselves so lucky [to have a job].' But your clients aren’t doing you a favour by giving you work, and you shouldn’t be doing them any favours by selling your labour for less than it’s worth.

However, not all industries allow the same opportunities for negotiation. Barrister Harriet explains 'There are two types of fees for me: legal aid fees and private fees. Legal aid rates are set by the Legal Aid Agency and are non-negotiable. In the worst cases this is as little as £46.50 a hearing - the average I get paid by the LAA is between £46.50 and £80 for a day in court. Factor in the fact that I, like most barristers, am self-employed, and things get a bit more bleak. If I get sick I don't get paid; if I get pregnant, I don't get paid - and, sometimes, when I turn up and do a really, really good job, I still don't get paid, either because the solicitors have folded because of legal aid cuts or because their own cash flow situation is so bad that they simply haven't got the funds to write me a cheque.'

The answer, for someone like Harriet, is to diversify. Although freelancing gives you the freedom to do the work you love, occasionally you have to compromise and balance the project you’re passionate about with the one that will pay your rent. ‘In my first year as a barrister I took on mainly Legal Aid work and earned just over £12k – turnover, not profit. In order to do the work I love, which is about protecting families, working with young vulnerable people and holding the government to account, I have to take on a fair amount of private cases. In theory, I can set my own rates for these, but in practice, they’re usually set by chambers’ clerks but I’m happy to leave it to them! My private cases are the only reason I’m able to practice as a barrister.’

If you are a fully freelance worker or business owner, women in all industries advocate doing your research and finding out what other people charge. Business owner and analyst Jane Kenyon suggests doing as much as you can to protect yourself before you get started on a project. ‘Define terms upfront from day one, and take a deposit where you can. Trust only comes with time. Take no chances. As for pricing, you only need to think about two things - what are the competition charging, and what will the market bear? We are so scared of rejection we cut our price but this can often be the reason we do not get a job. People equate price to value, and ‘cheap’ might be interpreted by clients as ‘not very good’.

But there will always be times when you’re self-employed where you’re earning less than you’d like to - and this is when you really need to start being strategic with the tiny pot of cash you do have. If you think there's a possibility that you've over-paid your taxes, for instance, then it definitely makes sense to file your tax return early because you'll get a refund sooner (everything at HM Revenue and Customs happens a bit slower just before the January deadline, when they're inundated with people doing their tex returns at the last minute). Plus, it means you completely avoid the chance of filing your tax return late and paying a fine (not ideal). On the other hand, if you owe money to the government (and you don't think you're due a refund), what's the point in paying it early? In this instance it makes sense to keep the money in a safe, interest-bearing account until the last minute when you absolutely have to pay - that way you can make the most interest on your cash.

Happily, I’ve found that the more I’ve written, the more confident I’ve become - and fortunately, the vast majority of clients I work for are fair and upfront about money. I’ve developed a sense for sussing out who might try to rip me off. Now that I’ve learned how to freelance and be financially OK, I’m not sure that I’d ever want a staff role with a salary. Being self-employed can be scary and frustrating, but getting paid for the work I love and doing it on my own terms is one of the greatest sources of satisfaction I have ever experienced. I rely on myself, so it’s part of my job to look after myself, identify my skills and make sure I’m appropriately valued. As a self employed freelancer, you should, one day, be able to look at yourself in the mirror and say 'I have an awesome boss.'

Follow Daisy on Twitter @notrollergirl

This article originally appeared on The Debrief.